ShareWine Trends Q1 2025

Every quarter, we release the ShareWine Trends report, where we comment on price development, trends, and interesting trading patterns based on fresh data from the marketplace and the global wine market.

Here is the report packed with data and trends for the first quarter of 2025. So grab a comfortable chair, pour yourself a glass, and read along in the first edition of ShareWine Trends this year 🍷

Overall trends

ShareWine launches in Italy

In 2025, ShareWine will ramp up efforts to expand the marketplace into more markets in Europe, and Italy was a major focus in the first quarter. With a large advertising campaign in March, the marketplace was launched fully translated into Italian, and in just a few weeks, several hundred Italian wine enthusiasts have joined the ShareWine community. The reception in Italy has been positive, and many new wine lovers have started trading. In the first quarter, sales from Italy grew by 350%, and some Italian sellers have passed their first 100 sales on ShareWine.

The number of wine auctions where the buyer was from Italy rose by 47% in the first quarter, and it's fantastic to see how the new Italian wine enthusiasts have been welcomed, and to see the exciting wines that are being listed for sale from this beautiful wine country.

We strongly encourage sellers to offer shipping to the EU, as it maximizes sales opportunities on the marketplace. Shipping wine to buyers within the EU is easy and safe on ShareWine, and sellers just need to be aware of the requirements for wine packaging.

Trading Activity in Q1

Overall, there was a significant amount of trading in Q1, with the number of sales transactions being 24% higher than the first quarter of 2024. In fact, trading activity was 1% higher than Q4 of 2024, which is very interesting, and in March, both the number of transactions and the number of bids on the marketplace hit record highs.

Price Development on the Secondary Market

After significant price drops in Q4, many were eagerly awaiting developments in the first quarter of 2025. A quick look at the major price indices on Liv-Ex is enough to conclude that this was not the quarter for a reversal of the price trends on the market. On the contrary, it was more “business as usual,” with continued price drops in all the major price indices, and the Liv-Ex FineWine50 dropped by -2.8%, FineWine100 by -1.3%, and FineWine1000 by -2%.

Regional Trends

Bordeaux

Dark clouds loom over Bordeaux, and globally the Bordeaux region is facing challenges on multiple fronts, and to call this crisis would not be an exaggeration. Exports continue to decline, and it is estimated that up to 400 million bottles are now left unsold in producers' cellars. At the same time, more loyal Bordeaux collectors are now turning their backs on the once-successful "en primeur" concept, as the profits are gone, and the concept has been hollowed out. Most recently illustrated in a disastrous “en primeur” sale of the 2023 vintage, where sales dropped by -25% despite significantly reduced prices.

The global Bordeaux price index Bordeaux500 dropped by -2.4% in Q1, and the bottom of Bordeaux prices is hard to find. However, the great Bordeaux vintages are showing more resilience against these drops, and the Bordeaux Legends 40 index (which tracks the price development of 40 Bordeaux wines from exceptional vintages since 1989) rose by 0.1% in the first quarter.

On ShareWine, the number of Bordeaux wine transactions was 17% higher than in Q1 2024, and -9% lower than Q4 2024 (which had a Bordeaux-themed auction).

Below are the price developments of two popular wines.

Burgundy

Lack of demand, however, is not a theme in Burgundy. Demand for Burgundy wines remains enormous, and nothing suggests this will change in the future. However, the region faces another major challenge: price. The combination of high demand and limited supply from top producers has driven prices up year after year, and they have now reached a level where prices on new allocations from many producers have “gone too far” and many wine enthusiasts are forced to decline, and thus lose their Burgundy allocations. On ShareWine, we are seeing a trend where Burgundy lovers are increasingly avoiding the most recent vintages, as you can often buy older vintages (3-5 years old) from the same producer at half the price of the new ones.

The price index Burgundy150 has experienced a significant drop through Q1, falling by -2.7%.

On ShareWine, the Burgundy category continues to grow, both in terms of the number of exciting bottles for sale and the number of sales transactions. In Q1, there were 46% more transactions with Burgundy wines than in Q1 2024, and transactions were 15% higher than Q4 2024, showing a very positive development in the marketplace's largest category.

Below is a fresh price measurement of Burgundy reds on ShareWine.

As always, it's exciting to follow the continued development in Burgundy.

Champagne

The number of Champagne transactions in Q1 was -6% lower than the same quarter in 2024, and -22% lower than the previous quarter (Q4), which is always ShareWine's largest Champagne quarter.

It will be interesting to follow Champagne sales in Q2, where there will be a Champagne-themed auction in April.

Globally, Champagne prices stabilized during the third and fourth quarters of 2024, but prices fell again in November, and in the first quarter of the year, the Champagne50 index showed a decline of -2.2%.

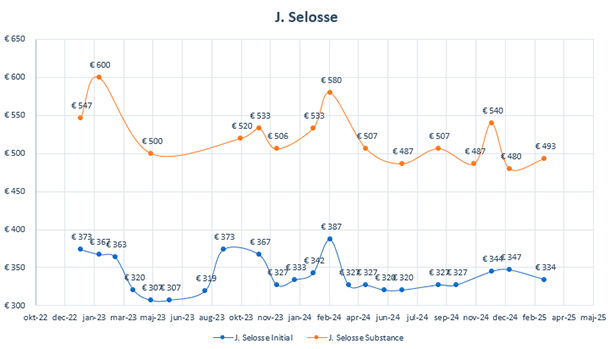

Below are the latest price developments on ShareWine for the 2008 vintage from large commercial Champagne brands as well as two wines from the Champagne grower Jacques Selosse.

Rhône

In Rhône, an interesting trend is emerging. The number of sales transactions has steadily increased over two quarters now, and in Q1, transactions were 37% higher than Q1 2024, and 12% higher than the previous quarter (Q4 2024). One might speculate that the -25% drop in prices over the past 24 months (Rhône100 price index) has attracted buyers looking for good deals. The Rhône100 index dropped by -2.8% in Q1.

Below is the price development of two Rhône wines from Chateau des Tours.

Jura & Loire

The trading level for Jura wine on ShareWine remains high, and even rose 3% from the previous quarter. Compared to Q1 2024, sales transactions were 6% higher in 2025.

The Loire region is also experiencing exciting development, and interest is rising, especially for white wines. Despite Loire still being one of the smallest categories on ShareWine, the growth is undeniable. In Q1, the number of transactions was 67% higher than the same quarter in 2024.

Italy

The year started somewhat differently across the Italian wine landscape. The number of sales transactions with wines from Piemonte and Veneto rose by 37% and 46%, respectively, compared to Q1 2024, while transactions with wines from Tuscany decreased by -2%.

Price-wise, Italian wines continue to show more resilience against the global price drops that have occurred in the secondary market since the end of 2022. The Liv-ex price index Italy100 zigzags up and down, and year to date, it has only fallen by -0.8%, performing much better than the French wines.

Below is the latest price development for selected popular Italian wines.

Spain

After strong growth in Spanish wine sales in 2024, there was a decline in the number of transactions with Spanish wine in the first quarter of 2025, and the trading level was -16% lower than Q1 2024 and -11% lower than the previous quarter (Q4 2024).

Below is the price development of Unico vintage 2006 from Vega Sicilia and three vintages of Flor de Pingus from Dominio de Pingus.

Germany

Trading in German wines exploded in 2024, and the positive trend for this wine category continues in 2025, with transactions being 129% higher than Q4 2024 and 58% higher than Q1 2024. Sehr gut ja!

We look forward to following the development and reporting fresh data and trends in the Q2 edition of ShareWine Trends, which will be released in July.

Thank you for reading, and happy trading!

Mikkel Lomholt

Founder of ShareWine